An LLC is a business entity that has become increasingly popular in recent years. LLCs offer flexibility, tax advantages, and protection from creditors. In addition, an LLC can be easily formed by filing a simple document with the state. However, a critical consideration for businesses contemplating an LLC is whether or not to obtain general liability insurance.

General liability insurance protects a business from financial losses caused by lawsuits filed by third parties. General liability insurance, also known as commercial general liability insurance (CGL) and LLC insurance is basic insurance coverage designed to protect the assets of your small business from claims that arise from normal business operations.

Most LLCs and small businesses choose to buy general liability insurance very soon after forming, as this will help to ensure they are protected in the case of an accident or catastrophe.

General liability insurance costs will vary depending on the size and risks involved with your business. Hence it is essential to learn more and get a quote.

What Is General Liability Insurance?

General liability insurance is a type of commercial liability insurance policy that protects a business from the financial burden of claims arising from bodily injury, personal injury, or property damage.

For many limited liability companies (LLCs), LLC insurance is an essential part of running a successful business. Business insurance for LLCs helps protect your company from claims that can come up during normal operations. Without it, you’d have to pay out of pocket to cover these claims, which can be very expensive

Whenever you start your own business, it is recommended to get general liability insurance coverage. General liability insurance coverage can protect your LLC if someone is injured on your business’s property, and it covers damage caused by you or your employees. The policy will cover your legal defense and the costs associated with the loss if you are found liable, up to the stated limits of your policy.

What Is LLC Insurance Coverage & How Much Does It LLC Cost?

General liability insurance for a startup or small business typically costs between $400 to $750 per year. That translates to between $42 and $92 every month. Not a gigantic price tag for the peace of mind you get. With it, you protect your business from most basic liability lawsuits and damages.

Most businesses pay between $350 to $900 per year for business owner policies (BOPs). However, LLC owners in some industries may also need professional liability insurance, which usually costs between $800 to $2,000 annually, as well as other policies like commercial auto or cyber liability insurance.

Several variables will affect the premiums for your specific business:

- Risk exposure (some businesses are more prone to risk than others).

- Location is generally based on ZIP code.

- Annual payroll amount (how many people you employ).

- Per occurrence limit (amount of coverage payable per incident).

- Aggregate limit (amount of coverage payable per policy period).

- Deductible.

NOTE:-The amounts above are for estimation purposes only. If you want an accurate cost of what general liability insurance would cost for your LLC.

An effective way to lower your premiums is to employ risk management procedures. At this moment your agent should have information on how to improve these procedures for your business. A business that follows proper processes will inherently lower the risk of an insurance claim.

What Does General Liability Insurance Cover?

As you know General liability insurance protects a business from a variety of possible claims including bodily injury, property damage, copyright infringement, reputational harm, and advertising injury.

- BODILY INJURY- caused by a business is a common claim. If someone comes to your place of business and is injured, a general liability policy would cover their medical costs. A bodily injury claim could be something as simple as a fall by a customer at a store or office.

- PROPERTY DAMAGE- is another common liability claim. Your business may be legally responsible if a person’s property is damaged while at your business. Property damage claims could also include damage to a client’s home or other property if you are visiting them on business.

- COPYRIGHT INFRINGEMENT- claims come about if you are accused of using someone else’s work in your business ad or other business marketing without their permission.

- REPUTATIONAL HARM -this can happen, for example, if you’re being interviewed by a news outlet and you say something about another company that hurts their business.

- LEGAL DEFENSE AND JUDGMENT

- ADVERTISING INJURY- this can happen if your business defames another person, business owner, or company.

These types of liability claims are prevalent, so you’ll want to keep your business protected with the right insurance. For example, the average cost of a slip and fall claim is $20,000. And if you face a reputational harm lawsuit, you could be facing $50,000 in costs, according to The Hartford.

A good way to extend your business liability insurance is by purchasing a commercial umbrella insurance policy. This gives you an extra layer of protection from expensive lawsuits.

What Does General Liability Insurance Not Cover?

As we know General liability insurance covers a lot for a business but it does not cover everything at all.

It won’t cover business-related auto accidents, employee injuries, illnesses, damage to your business property, mistakes in professional services, claims that exceed your policy limit, or illegal acts by you or your employees.

For these kinds of liability claims, you will need different types of business insurance, which are given below:

- EMPLOYEE INJURIES AND ILLNESSES- You need workers’ compensation insurance to provide coverage for employee injuries.

- AUTO ACCIDENTS- For auto accidents while doing business, a commercial auto insurance policy financially protects you if you own the car. Hired or non-owned auto insurance offers protection if you use a personal car or rented car for work.

- PROFESSIONAL MISTAKES- An errors and omissions insurance (E&O) policy provides coverage if you make mistakes in the course of your work. An E&O policy is sometimes called professional liability insurance.

- THEFT AND DAMAGE TO YOUR BUSINESS PROPERTY-General liability insurance won’t cover your business equipment or property against theft or damage. You need a commercial property insurance policy to cover these types of problems.

- Coverage that exceeds the limits of standard insurance (umbrella liability insurance).

- Intentional acts.

- Warranties offered by your business.

- Damages to clients from professional advice or services.

NOTE: Insurance won’t cover intentional acts, such as a computer you throw out the window. And general liability insurance won’t help if there are deliberate, illegal acts or wrongdoings by you or your employees.

To ensure that your LLC is covered in the case of any loss, be sure to take a look at your business’s specific risks and plan your insurance coverage around that.

Estimated Insurance Costs for Small Business

The first policy that most business owners need – and also the least expensive – is general liability insurance (LLC). In commercial insurance, the median cost of a general liability policy was $42 per month or $500 per year.

The median cost of a business owner’s policy (BOP), which bundles general liability insurance with business property coverage at a discount, was $53 per month or $636 annually.

The table below shows the median and average monthly costs for common small business insurance policies. The median better represents what you are likely to pay when talking about insurance costs because it excludes extremely high and low premiums.

Median and average monthly costs of small business insurance

| Policy | Median cost | Average cost |

| General liability | $42/month | $65/month |

| Business owner’s policy (BOP) | $53/month | $99/month |

| Professional liability (E&O) | $59/month | $97/month |

| Workers’ compensation | $47/month | $111/month |

| Commercial umbrella | $75/month | $129/month |

Insurance Costs Also Depend On Your Chosen Profession

Because general liability insurance covers third-party bodily injury and property damage, professionals who engage with the public typically pay more for this policy. Higher risks mean greater odds that you’ll file a claim, which means higher costs for insurance coverage.

For example, general liability insurance costs are generally high for retailers, but low for consultants who work on their own.

Insurance rates are different for different businesses or industries such as

Building design

Cleaning services

Construction and contracting

Consulting

Finance and Accounting

Food and beverage

Healthcare professionals

Human and social services

Insurance professionals

IT/technology

Media and Advertising

Photo and video

Real estate

Retail

Sports and Fitness

There are other ways to save, too. Sometimes you can bundle policies for a discount. The most common bundle is a business owner’s policy, which includes general liability insurance and commercial property insurance.

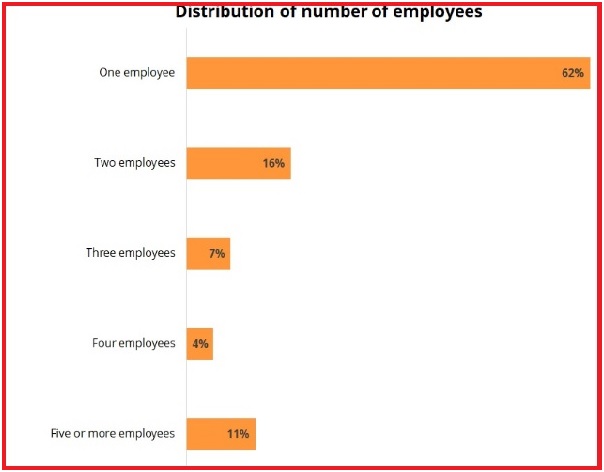

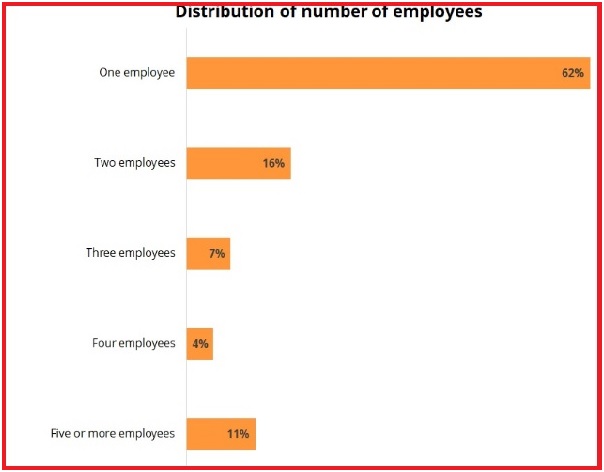

Some/Many businesses have only one employee involvement

The number of employees can impact your insurance costs, especially for policies like workers’ compensation insurance. The majority of small businesses (62%) in this analysis have only one employee. Another 16% of businesses had two employees.

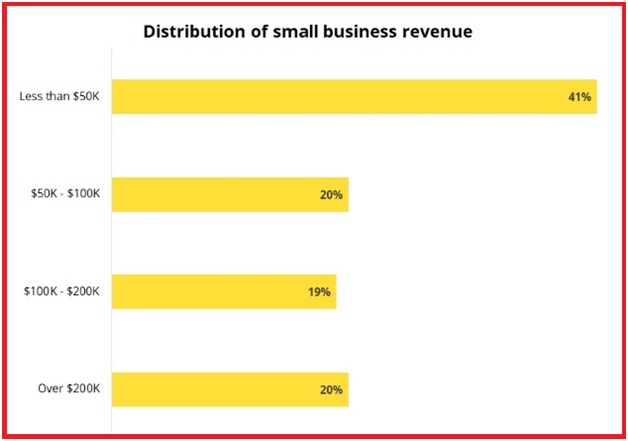

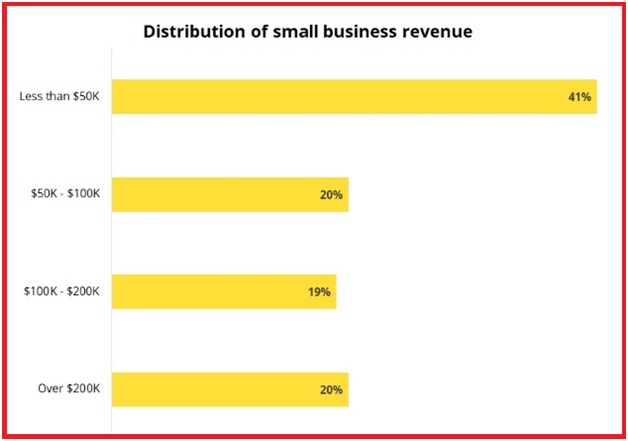

Almost 60% of Businesses Earn Less Than $100,000 Annually

As revenue also impacts the cost of small businesses if we consider an example, a small business that earns less than $1 million in annual revenue may be eligible for a cost-saving business owner’s policy. Also, the median revenue of the small businesses included in this analysis is $60,000. The majority of clients (around 60%) have less than $100,000 in annual revenue.

Benefits of Having General Liability Insurance (LLCs)

It has great importance for everyone involved in the business because, in a claim situation, a commercial general liability policy will protect your LLC’s assets. There are, however, other tangible benefits of your LLC carrying liability insurance. Having a general liability insurance policy you will observe the following benefits:

- Demonstrates that you have a secure and well-established business: Displaying to your clients that you are not just a “fly-by-night” company by protecting their assets is a great selling feature. Handing them a copy of your insurance certificate will instill confidence that you are the right company to get the job done.

- This shows that you care about your employees: Employees can rest a bit easier if they know that their work is protected and backed by insurance.

- May help you gain/optimize your business: Potential clients sometimes require an insurance policy to be in place, as they don’t want to be held liable for any possible mistakes. Holding an insurance policy may make the difference between your bid and your competitor’s.

Does My LLC or Company Need General Liability Insurance?

If your business owns real estate or is involved in other valuable assets, then at this place general liability insurance is a highly recommended investment. The typical price of premiums falls between $400 and $1,000 per year based on your coverage needs and line of work. Liability insurance can protect your business from the financial burden of litigation, which can easily cost tens to hundreds of thousands of dollars.

Considering the comparatively low cost of premiums, a general liability insurance policy is a small price to pay for the protection and peace of mind it offers.

Frequently Asked Questions (FAQS)

For many limited liability companies (LLCs), LLC insurance is an essential part of running a successful business. Business insurance for LLCs helps protect your company from claims that can come up during normal operations. Without it, you’d have to pay out of pocket to cover these claims, which can be very expensive.

Business liability insurance helps you to cover the cost of injury and property damage claims against a business. It can help pay for medical care, repair or replace damaged property, and legal fees for covered claims. A liability policy may also cover costs related to errors or misstatements in advertising.

General liability insurance (GLI) is sometimes called business liability insurance or commercial general liability insurance. This type of liability insurance coverage helps protect your business from claims of bodily injury or property damage that can come up during normal business operations.

As an individual, you, and your spouse are insured, but only concerning the conduct of a business of which you are the sole owner. In a partnership or joint venture, you are insured. Your members, your partners, and their spouses are also insured, but only concerning the conduct of your business.

In most cases, no, your LLC is not required by law to carry insurance. Some employers or clients might require you to carry a certain amount of general liability insurance before you can work for them. Some property owners may require that you hold liability insurance when renting business space. Businesses in some industries like electricians, plumbers, and handymen use “Licensed and Insured” as a marketing phrase.

Possibly yes, LLCs are not necessarily impenetrable entities. The answer to this question is more of a legal matter than an insurance one and in this case, you have to also consult with your attorney about which of your assets could be exposed.

General Liability Insurance is just one type of commercial liability insurance coverage. There are other types of liability insurance policies for small businesses. The most notable is professional liability insurance. While covering different types of risks, professional liability is also a type of liability insurance.

If your insurance company’s maximum limits do not meet your needs, you should look into a commercial umbrella policy. An umbrella policy acts over and above your liability insurance policies and typically minimizes the cost of individual coverage. Consult with your insurance agent if you feel that your limits are not high enough.

In this case, you have to request a Certificate of Insurance (LLC) from your agent. This is a short document that will show your coverage and limits to potential clients.

Depending on the type of loss or claim, your CGL policy may cover damage to intellectual property. This may include the loss of a client’s data in a hack on your system. Consult your agent for policy specifics and take all the details regarding your LLCs.

There is no difference between general liability and commercial general liability insurance. These are two terms that both signify the same insurance coverage.

General aggregate is a component of your liability insurance policy. Your policy has two “limits” built-in: “per occurrence limit”, which is the limit of coverage per claim, and “aggregate limit”, which is the total limit of all coverage per policy period.

PIP insurance functions differently than traditional forms of car insurance. Instead, it focuses specifically on bodily injuries. Georgia is an at-fault state, which requires the other driver to pay for your damages if you were at fault. However, when you are at fault and have to cover your damages, PIP insurance helps fill in the gap. Your insurance coverage will only reimburse you for some of your damages and, in many cases, does not cover medical bills depending on your policy. You can find out more from legal professionals.

An LLC is a limited liability company, which is a business that is completely separate from your finances. It’s more complicated to create an LLC than to simply run your business as a partnership or sole proprietorship, but there are real advantages to setting up an LLC.

Conclusion

There are plenty of calamities that can put a serious dent in your bottom line. For instance, your employee might spill a can of white paint on merchandise. Or a customer might get hurt after tripping on a rug in your store. Or you could be sued for reputational harm due to something you or your employee said.

Holding an insurance policy may make the difference between your bid and your competitor’s.

General liability insurance covers a small business from these types of problems (and more). It’s an essential coverage type for the best small business insurance.

General liability insurance costs will vary depending on the size and risks involved with your business. Hence it is essential to learn more and be cautious regarding this matter.

Thanks For Visiting this website any doubts, you can comment below; if you want to latest updates on this type of helpful information, follow Google News.