Updated October 02, 2022 – Do credit cards have routing numbers? The short answer is no, but the long answer is a bit more complicated. Credit cards do not typically have routing numbers, but there are a few exceptions. For example, Visa cards have a three-digit routing number that is used to process the payments. American Express also has a three-digit routing number that is used to process the payments.

A lot of people inquire whether routing numbers are present on credit cards. This is a common question asked by people who aren’t familiar with the specifics of each banking option. Simply put credit cards have routing numbers. However, the routing numbers they need to do to connect to an account and what makes routing numbers distinct can lead to fascinating questions. Let’s look at the answers.

What is a Routing Number?

A nine-digit code used to identify a financial or bank establishment in the United States is called a routing number. It’s a crucial element to be used when making payments for internet transfers as well as when processing checks.

Clearinghouses rely on routing numbers to process financial transactions. Online banking is also not able to function in a lack of routing numbers.

Some financial institutions do not are issued a routing number, however. Only state-chartered and federally-chartered banks that can open an account with the Federal Reserve Bank are issued routing numbers.

When making the wire transfer routing numbers play a crucial function. There is no physical currency that is transferred between banks during a transfer. It’s information that’s transmitted from one bank to the next.

The transaction must be accompanied by the proper routing numbers in order to pass without issue. Routing numbers can also be used in direct deposits by employers to employees’ accounts in banks and also for income tax refunds issued by the Internal Revenue Service.

Routing numbers can not always be identified as the same. There are several terms used in the industry to describe the exact nine-digit number such as routing transit numbers, as well as ABA numbers. ABA is an abbreviation to refer to the American Bankers Association, a reference to how it was ABA that created routing numbers in 1910.

HOW CAN YOU FIND YOUR ROUTING NUMBERS

There were multiple ways by which you can find your Routing Numbers such as;

[1.] By using the U.S.A Mobile Apps.

[2.] By Net Banking.

[3.] By using your Checkbook leaf.

[4.] By your Bank Statement.

[5.] By taking the help of the U.S.A Routing Numbers Directory.

How can you locate your routing number for your account

If you sign up for an account with an institution of finance they will provide you with documentation that contains detailed information regarding the services you’ve just signed up for. This includes the account number assigned to your new account as well as the routing number that you’ll require for direct deposits and transfers.

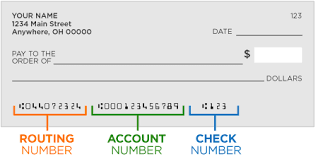

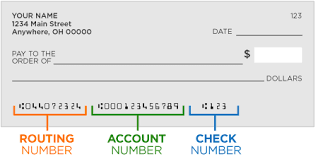

Another way to locate the routing number is to take the time to look over your bank account. The initial nine digits to the left side of the bottom of your check are the routing number.

The first four numbers identify that it is the Federal Reserve Bank of the district in which the institution is situated. The following four digits represent the bank and the last number indicates whether it’s an unredeemable check or a non-negotiable instrument.

Financial institutions also have made it easier for you to locate crucial information regarding your accounts via their websites and mobile apps. If you’ve registered for these services, you’ll quickly find your routing number on the portal online or through an app.

Are the Credit Cards contain routing numbers?

Credit cards do not come with routing numbers. However, credit cards don’t require routing numbers. We’ve discussed before that routing numbers are needed to transfer funds between accounts via wire transfers, checks, and so on. This is not what the purpose of a credit card is.

It’s simple to see why the myth regarding credit cards that have routing numbers originates. Each credit card comes with a 16-digit number that is connected to them. It can be located placed on the front or side of the credit card.

Modern cards tend to have a minimalist design and don’t provide specific numbers or numbers on the card however, instead they offer that information to the customer via an app.

What credit cards have account numbers? The account number is the connection between the card’s issuer and the cardholder. This data is vital to processing payments. The first digit of the card number indicates the kind of card. If the number begins with 3, then the card is an American Express card. Visa cards begin with four, while the number of a Mastercard starts with five. Discover cards start by putting the numeral six.

The following six-to-8 numbers are known by the name of the issuer ID number. These numbers are also referred to as the bank identification number. These numbers identify the bank that has issued the card.

The remaining numbers are unique to each cardholder and are used to identify the user’s specific credit card at the financial institution they are with. The digits are chosen by the issuer of your card in order to identify the account number.

Why aren’t Credit Cards issued with the routing number?

The primary purpose of credit cards isn’t to make wire transfers as well as direct deposits. The user isn’t spending their own money when using the credit card to make a purchase. It’s the bank that provides them with a particular credit limit they are able to make use of each month.

If the card is used to pay and the bank reimburses the merchant in complete. The cardholder does not have to make a payment to the bank instantly. The only time they have to pay when the billing cycle is over is the bank is legally required to pay the funds it already transferred on behalf of the client in advance to the vendor.

In such transactions, the routing number is not needed. Settlement mechanisms for credit card payments differ from direct and wire transfer deposits. They don’t rely on a routing number in order to complete the transactions. This is why credit cards don’t require routing numbers.

Why don’t credit card companies have routing numbers?

In essence, the credit card doesn’t require routing numbers since they don’t need these numbers. Routing numbers are required for the transfer of funds between banks.

If you make use of credit cards in this way, you’re taking money out of the issuer of your card instead of using funds in your account. In these types of transactions, the mechanism for payment settlement differs from that of direct deposits and wire transfers. The funds aren’t transferred between accounts. Instead, you’re borrowing money from a bank and paying it back in the future. This is the reason routing numbers aren’t needed.

What is a debit card?

Credit card numbers are typically 16 numbers (15 digits in some instances) They can be located on the back of your card’s physical.

Similar to routing numbers, numbers in the credit card number carry meanings. The initial four to six digits are referred to as an issuer ID number (IIN) or it’s the number for the bank (BIN). This is the identifier for the financial institution or the bank that provided the credit card.

Following this, the IIN will be the number of your account. It can only be used by the cardholder and could range between 6 and 12 numbers. Additionally, every credit card is issued with an identifier for checks that is used to confirm the card’s authenticity. The majority of credit card providers such as Mastercard, Discover, and American Express — use the last digit to indicate the check digit. Only Visa makes use of the 13th number.

Credit card number vs. routing number

The 16-digit code on your credit card is used for an entirely different function than the banking routing numbers. Routing numbers are nine-digit numbers that are used to direct payments and money transfers to banks. While routing numbers for banks are crucial for transferring and receiving money between banks, they’re not required for credit card transactions.

Your credit card’s 16-digit code is, however it is utilized to verify your account as well as the financial institution which gave you the credit card. As opposed to routing numbers, the credit card’s number is exclusive to you and permits you to purchase on the internet.

Where are your routing numbers?

You will typically locate your routing number when you log into your bank account online and search for the section titled “Account Details.” The routing number will be displayed there alongside the bank account number as well as other important details.

It is also possible to find your routing numbers on the checkbook paper. It’s the number that is located on the lower left corner of your check on the left side of the account number.

If you’re not able to log in to your online bank account or paper check, contact your bank’s customer service number. They’ll be able to give you the right routing number.

Conclusion

Credit cards do not have routing numbers, as these numbers are used to transfer money between bank accounts or different financial institutions. Instead, credit cards have a 15- or 16-digit number that identifies the issuing company and the holder’s account number.

Thanks For Visiting this website any doubts, you can comment below; if you want to latest updates on this type of helpful information, follow Google News.