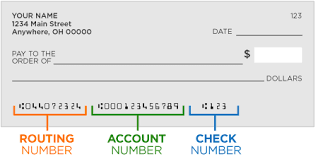

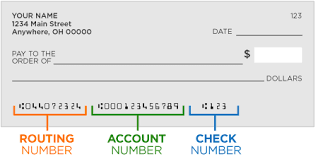

The Routing Number is the “Nine-Digit Number” printed on the bottom left corner of each check. Your specific account number usually contains 10 to 12 digits the second set of numbers printed on the bottom of your checks. The number which is furthest to the right is the check number.

All bank-related financial transactions require two pieces of information to identify customers: The Routing Number and the Account number, both of which are assigned when you open an account.

Account, as well as your Routing numbers, work together to identify your account and it ensures that your money goes up to the right place/ or exact beneficiary.

In Financial InstitutionS Routing Numbers are known as RTNs (Routing Transit Numbers) or ABA (American Bankers Association) routing numbers.

Both numbers are required to complete all the basic Banking Transactions.

The routing number indicates what bank your account is held in.

The account number is your unique identifier at that bank.

American Bankers Association or ABA SYSTEM is a sequence of nine digits used by banks to identify specific financial institutions within the United States.

WHEN DO I NEED TO USE MY ROUTING NUMBERS

As you know Financial Institutions use your Routing Number whenever you want to make any financial transactions in the UNITED STATES OF AMERICA. It will be asked by you when you;

There are a few scenarios when you might need to use your routing numbers:

1. When you are ordering goods or services from a third party

2. When you are sending goods or services to a customer

3. When you are filing a claim with your carrier

4. Set up a direct deposit.

5. While paying an online bill or by phone.

6. When you are making a wire transfer.

HOW CAN YOU FIND YOUR ROUTING NUMBERS

There are multiple ways by which you can find your Routing Numbers such as;

How can you find your routing numbers? In most cases, you can find your routing numbers on the front or back of your checking or savings account statement. However, if you don’t have a statement, you can find your routing numbers by calling your bank. Your bank may also be able to provide you with other information about your accounts, such as the account number and the IBAN (International Bank Account Number).

[1.] By using the U.S.A. Mobile Apps.

[2.] By Net Banking.

[3.] By using your Checkbook leaf.

[4.] By your Bank Statement.

[5.] By taking the help of the U.S.A Routing Numbers Directory.

How to Find a Routing Number Without any Cheque

If you don’t have a chequebook, you can still find your routing number by checking your bank’s website or calling your local branch. The routing number varies by bank and region. Since one bank can have multiple routing numbers, be sure to confirm that your routing number corresponds to the specific bank where you opened your account.

We’ve included a list of some of the major national lending institutions with links to their respective routing numbers.

- Bank of America, N.A.

- BB&T

- Chase Bank

- Citigroup Inc.

- Fifth Third

- First Republic

- HSBC

- Huntington National Bank

- KeyBank

- M&T Bank

- Regions Bank

- Santander

- SunTrust

- TD Bank

- Union Bank

- US Bank

- Wells Fargo

- Zions Bank

BANK OF AMERICA ROUTING NUMBERS

It confirms that your state’s routing number below is the same on your checks or when you are logging in to Internet banking.

DISCLAIMER:- As we know these are Bank of America routing numbers for checking accounts for electronic payments only, but some states or regions have different routing numbers for Checks and Electronic Payments. In most cases, there are separate routing numbers for Wire Transfers as well.

| State | Routing number |

|---|---|

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900254 |

| Delaware | 031202084 |

| Washington, D.C. | 054001204 |

| Florida | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois (South and Chicago Metro) | 081904808 |

| Illinois (North) | 071000505 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 064000020 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071214579 |

| Mississippi | 051000017 |

| Missouri | 081000032 |

| Montana | 051000017 |

| Nebraska | 051000017 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas | 111000025 |

| Utah | 123103716 |

| Vermont | 051000017 |

| Virginia | 051000017 |

| Washington | 125000024 |

| West Virginia | 051000017 |

| Wisconsin | 051000017 |

| Wyoming | 051000017 |

Chase Routing Numbers

It confirms that your state’s routing number below is the same on your checks or when you are logging into internet banking.

DISCLAIMER:- As we know these are Chase routing numbers for checking accounts for electronic payments only, but some states or regions have different routing numbers for Checks and Electronic Payments. In most cases, there are separate routing numbers for Wire Transfers as well.

| State | Routing Number |

|---|---|

| Arizona | 122100024 |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Florida | 267084131 |

| Georgia | 061092387 |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Michigan | 072000326 |

| Nevada | 322271627 |

| New Jersey | 021202337 |

| New York (Downstate) | 021000021 |

| New York (Upstate) | 022300173 |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Texas | 111000614 |

| Utah | 124001545 |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

Wells Fargo Routing Numbers

It confirms that your state’s routing number below is the same on your checks or when you are logging into internet banking.

DISCLAIMER:- As we know these are wells Fargo routing numbers for checking accounts for electronic payments only, but some states or regions have different routing numbers for Checks and Electronic Payments. In most cases, there are separate routing numbers for Wire Transfers as well.

| State | Routing number |

|---|---|

| Alabama | 062000080 |

| Alaska | 125200057 |

| Arizona | 122105278 |

| Arkansas | 111900659 |

| California | 121042882 |

| Colorado | 102000076 |

| Connecticut | 021101108 |

| Delaware | 031100869 |

| Washington, D.C. | 054001220 |

| Florida | 063107513 |

| Georgia | 061000227 |

| Hawaii | 121042882 |

| Idaho | 124103799 |

| Illinois | 071101307 |

| Indiana | 074900275 |

| Iowa | 073000228 |

| Kansas | 101089292 |

| Kentucky | 121042882 |

| Louisiana | 121042882 |

| Maine | 121042882 |

| Maryland | 055003201 |

| Massachusetts | 121042882 |

| Michigan | 091101455 |

| Minnesota | 091000019 |

| Mississippi | 062203751 |

| Missouri | 113105449 |

| Montana | 092905278 |

| Nebraska | 104000058 |

| Nevada | 321270742 |

| New Hampshire | 121042882 |

| New Jersey | 021200025 |

| New Mexico | 107002192 |

| New York | 026012881 |

| North Carolina | 053000219 |

| North Dakota | 091300010 |

| Ohio | 041215537 |

| Oklahoma | 121042882 |

| Oregon | 123006800 |

| Pennsylvania | 031000503 |

| Rhode Island | 121042882 |

| South Carolina | 053207766 |

| South Dakota | 091400046 |

| Tennessee | 064003768 |

| Texas | 111900659 |

| Texas (El Paso) | 112000066 |

| Utah | 124002971 |

| Vermont | 121042882 |

| Virginia | 051400549 |

| Washington | 125008547 |

| West Virginia | 121042882 |

| Wisconsin | 075911988 |

| Wyoming | 102301092 |

CONCLUSION:- Routing numbers are most commonly required when reordering checks, for payment of consumer bills to establish a direct deposit (such as a paycheck), or for tax payments. The routing numbers used for domestic and international wire transfers are not the same as those listed on your check leaves.

Thanks For Visiting this website any doubts, you can comment below; if you want to latest updates on this type of helpful information, follow Google News.