Updated August 02, 2022 – Tjmaxx Credit Card: Today we will know about TJ Maxx credit card, tjmaxx credit card login, How to tjmaxx credit card payment, and How to tjmaxx credit card sign in; this article is significant for tjmaxx credit card Customers every detail about TJ Maxx credit card, So read this whole article carefully.

TJMAXX Credit Card

The TJMAXX Credit Card is designed for frequent shoppers of TJMaxx and its affiliated brands like Marshalls, Home Goods, and Sierra Trading Post. TJMAXX Users receive significant points (5x) for each dollar spent at those stores. Due to the limited nature of the TJ MAXX Credit Card, though, it should only be considered if you shop regularly at those companies. Like most other store-loyalty credit cards, it comes with a significant APR, and no annual fee.

Your TJX Rewards® credit card is issued by Synchrony Bank. The Synchrony Bank Privacy Policy governs the use of the TJX Rewards® credit card. The use of this site is governed by the use of the Synchrony Bank Internet Privacy Policy, which is different from the privacy policy of TJX.

TJ Maxx / TJX Credit Card Info

| Credit Card Name | TJ Maxx / TJX Credit Card |

| Credit Card URL | https://tjmaxx.tjx.com/store/jump/topic/TJX-Rewards-Credit-Card/2400012 |

| Credit Card Issuer | Synchrony Bank |

| Credit Card Payment Phone Number | 1-877-890-3150, 1-800-952-6133 |

| Credit Card Payment Address | TJX Platinum Mastercard P.O. Box 530949 Atlanta, GA 30353. Or, TJX Store Credit Card P.O. Box 530948 Atlanta, GA 30353 |

| Cash Advance Fee | 4% (min $10) |

| Cash Advance APR | 29.99% |

| Foreign Transaction Fee | 0 |

| Smart Chip | Yes, chip-and-PIN |

| Max Late Fee | $38 |

| Max Overlimit Fee | $0 |

| Max Penalty APR | None |

| Grace Period | 23 days |

How to apply for the T.J. Maxx card?

The easiest way you can apply for the TJX Credit Card is online. Otherwise, you could apply in person at any of the following T.J. Maxx store locations:

- T.J. Maxx

- Marshalls

- HomeGoods

- Sierra

- Home Sense

Keep in mind that you’ll need to have at least good credit to get approved for the TJX Credit Card. Approval odds are higher with the TJX Store Card, which requires fair credit or better. The issuer will also look at your income-to-debt ratio and credit history.

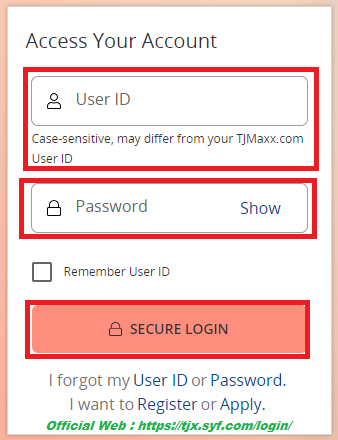

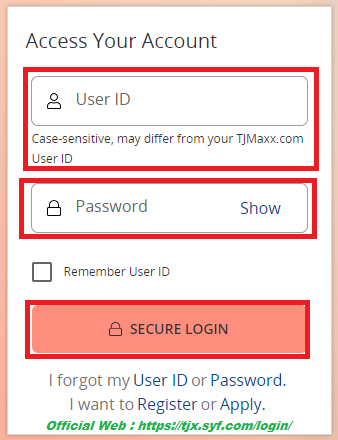

How to TJMAXX Credit Card login

Now let us get started with this guide and check out the methods for TJMAXX Credit Card Login Online. They are as mentioned below. Never forget any step to log in to TJMAXX Credit Card; read the step given below.

Step 1: First of all visit the official website of TJMAXX Credit Card or click on this link [https://tjx.syf.com/login/].

Step 2: After visiting tj Maxx credit card login homepage see the left sidebar as shown below pic.

Step 3: After that enter your TJMAXX Credit Card, User ID (Case-sensitive, may differ from your TJMaxx.com User ID), and password.

Step 4: After filling in the TJMAXX Credit Card user id and password click on secure login.

Step 5: You are login in successfully to TJMAXX Credit Card Online Portal.

After reading the above steps, I hope you can quickly login in TJMAXX Credit Card online portal.

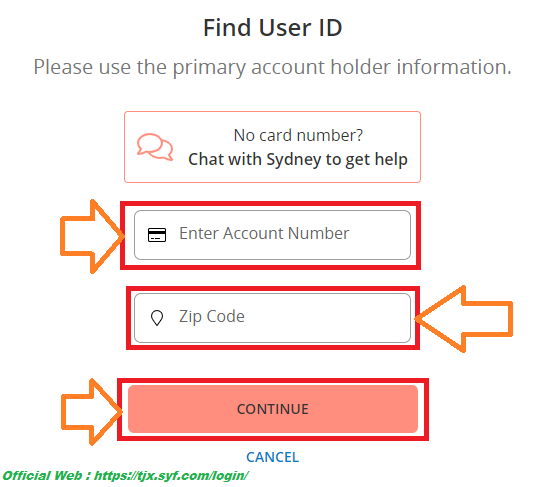

TJMAXX Credit Card Forget User ID

If you have forgotten the TJMAXX Credit Card User Id, follow this process below; never forget any steps to bypass the TJMAXX credit card user id.

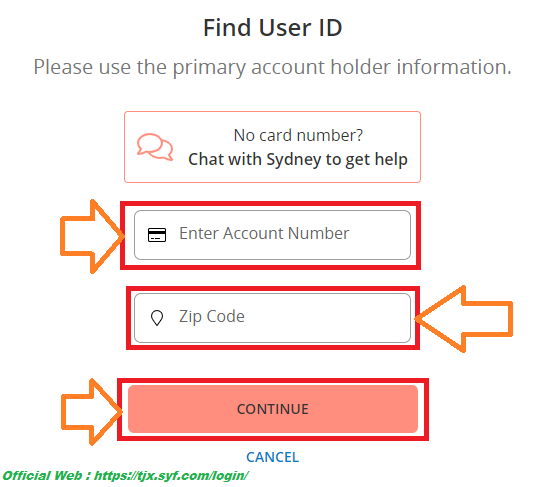

Step 1: First of all visit the official website of TJMAXX Credit Card or click on this link [https://tjx.syf.com/login/].

Step 2: After visiting the TJMAXX Credit Card homepage click on I forget my User Id or [https://tjx.syf.com/login/findUserId].

Step 3: After that enter your Account Number, and zip code.

Step 4: After filling, in all details click on continue.

Step 5: After verification, your TJMAXX User Id is sent to your mail Id.

After following this process, I hope you can quickly get your TJMAXX forgotten user id.

TJMAXX Credit Card Forget Password

If you want to know how to forget TJMAXX Credit Card Password, this article is significant for you never to ignore any steps to forget TJMAXX Credit Card Password.

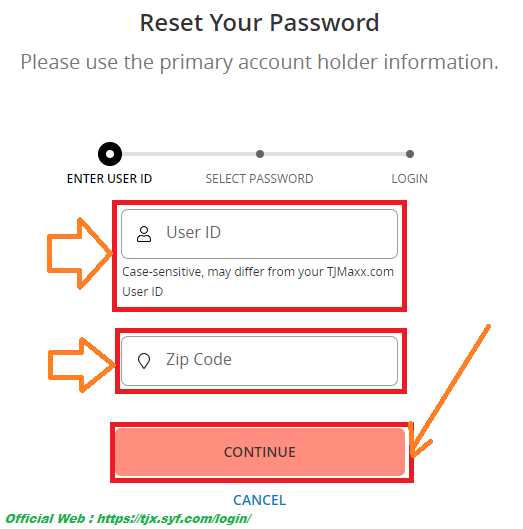

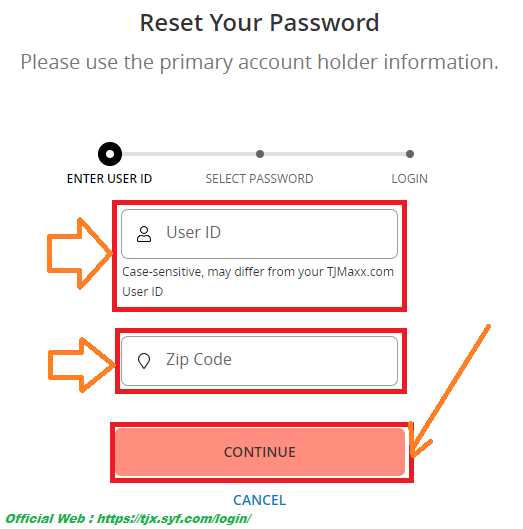

Step 1: First of all visit the official website of TJMAXX Credit Card or click on this link [https://tjx.syf.com/login/].

Step 2: After visiting the TJMAXX Credit Card homepage click on I forgot my password or [https://tjx.syf.com/login/reset].

Step 3: After that enter your User Id, and zip code.

Step 4: After filling, in all details click on continue.

Step 5: After that enter your new TJMAXX Credit Card login Password, and again enter confirm password.

Step 6: Your tjmaxx credit card login password was reset successfully.

After following this process, I hope you can easily reset your TJMAXX credit card forgotten password.

Also Read: Credit Card Meaning

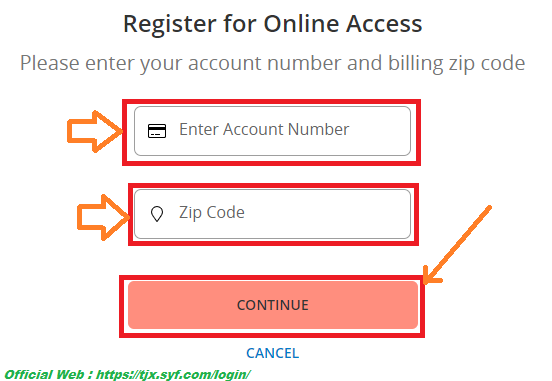

TJMAXX Credit Card Register online

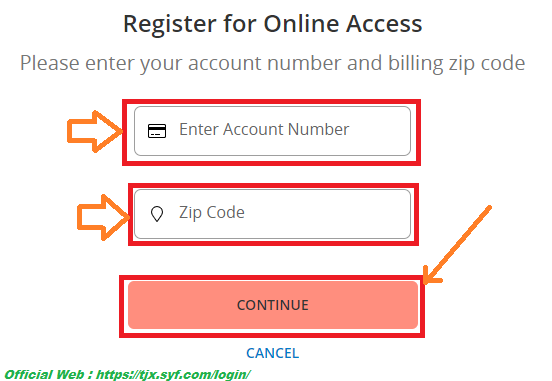

If you want to know How to Register TJMAXX Credit Card online, this article is significant for you; never forget any steps to register TJMAXX Credit Card online.

Step 1: First of all visit the official website of TJMAXX Credit Card or click on this link [https://tjx.syf.com/login/register].

Step 2: After visiting the TJMAXX Credit Card homepage click on I want to Register or apply [https://tjx.syf.com/login/register].

Step 3: After that enter your Account Number, and zip code.

Step 4: After filling, in all details click on continue.

Step 5: After verification, your TJMAXX User Id is sent to your mail Id.

After following this process, I hope you can easily register tjmaxx credit card online.

Some Basics Point of TJMAXX Credit Cards

You can get two different types of credit cards from TJMAXX, both of which are issued by Synchrony Bank:

- The first is the TJX Rewards Credit Card, which is a store card that can only be used at T.J. Maxx and its partner brands in the U.S. and Puerto Rico or through any of the brands’ websites.

- The second is the TJX Rewards Platinum Mastercard, which can be used anywhere Mastercard is accepted. This article will focus primarily on the TJX Rewards Credit Card.

Is the TJX Rewards® credit card worth it?

TJMAXX offers two credit cards for customers, the TJX Rewards Credit Card and the TJX Rewards Platinum Mastercard. TJX Rewards credit cards are used only in affiliated stores, and the second TJX Rewards Platinum Mastercard use everywhere.

10% off your first online or in-store purchase with your card

Earn 5 points for every $1 you spend on purchases at T.J.Maxx, Marshalls, HomeGoods, Sierra, and Homesense stores in the U.S. and Puerto Rico and online at any participating eCommerce site operating under any of the foregoing brands.

Earn 1 point per $1 spent everywhere else. Points do not expire.

Receive $10 in TJX reward certificates for every 1,000 points earned.

TJX Rewards® Credit Card benefits and features

- Earn 5% cash back in rewards for every dollar spent at T.J. Maxx, Marshalls, HomeGoods, and Sierra Trading Post.

- There is no limitation to the number of rewards you can earn.

- 10% off your first card purchase in-store.

- $10 rewards certificate redeem 1,000 points for a $10 rewards certificate.

- The best benefits part of this tjmaxx credit card is No annual fee charge.

5 Things to Know About TJMAXX Credit Card

- Earn 5% back on TJMAXX purchases

- Get a 10%-off welcome bonus

- Special discounts for cardholders

- Relatively high APR

- Must be used at TJMAXX Stores

How to Pay TJMAXX Credit Card Payment Online

Here is how to make a TJMAXX Credit Card bill payment:

- Online: Simply log in to your TJMAXX Credit Card online account to make a payment and manage your account.

- By Phone: Call TJMAXX Credit Card customer service at 1-877-890-3150, 1-800-952-6133, and follow the prompts to make a payment.

- By Mail: Send your cheque or money order to the following address:

- Note: Before sending any details please call TJMAXX Credit Card Customer Service and Confirm the Mailing Address.

TJX Platinum Mastercard

P.O. Box 530949

Atlanta, GA 30353.

Or,

TJX Store Credit Card

P.O. Box 530948

Atlanta, GA 30353

How to Pay TJMAXX Credit Card Payment via Phone

To pay a TJMAXX Credit Card Payment by phone, call the customer service number for your card:

TJMAXX Credit Card also lets you pay credit card transactions by phone for free. To make a payment over the phone, you must collect the credit card’s number along with your bank account number as well as your Credit Card Details.

For TJMAXX Credit Card Payment via Phone Call 1-877-890-3150, 1-800-952-6133. After the call Follow the automated prompts to schedule your payment.

How to Pay TJMAXX Credit Card Payment via Mail

There’s also the option of mailing the TJMAXX Credit Card Payment. Make your payment by cheque or money order to an amount that is at the least of your amount due. The payment should be accompanied by the payment coupon on your bill statement or write your account’s number on the cheque. Send the check to the address that is associated with your credit card.

Note: Before sending any details please call TJMAXX Credit Card Customer Service and Confirm the Mailing Address.

For TJMAXX Credit Card Payment Address:

TJX Platinum Mastercard

P.O. Box 530949

Atlanta, GA 30353.

Or,

TJX Store Credit Card

P.O. Box 530948

Atlanta, GA 30353

FAQ of TJMAXX Credit Card

Answer : > First of all visit the official website of TJMAXX Credit Card or click on this link [https://tjx.syf.com/login/].

> After visiting the TJMAXX Credit Card homepage see the left sidebar as shown below pic.

> After that enter your TJMAXX Credit Card, User ID (Case-sensitive, may differ from your TJMaxx.com User ID), and password.

> After filling in the TJMAXX Credit Card user id and password click on secure login.

> You are login in successfully to TJMAXX Credit Card online Portal.

Answer : > https://tjx.syf.com/login/

Answer : > TJ Maxx Mastercard phone number: 1-877-890-3150

> TJ Maxx store credit card phone number: 1-800-952-6133

Answer : > Note: Before sending any details please call TJMAXX Credit Card Customer Service and Confirm the Mailing Address.

TJX Platinum Mastercard

P.O. Box 530949

Atlanta, GA 30353.

Or,

TJX Store Credit Card

P.O. Box 530948

Atlanta, GA 30353

Answer : > You can apply for the TJX Rewards Credit Card online.

Answer : > You can use the TJX Rewards Credit Card exclusively at TJ Maxx, Marshalls, HomeGoods, and Sierra Trading Post.

You must activate your rewards card once you receive it. To activate the credit card follow the steps given below.

Step 1: Just visit the login page of the TJX Rewards Credit Card.

Step 2: Click on the “Chat for Login or Registration Help” link placed on the right side of the page.

Step 3: A virtual assistant chatbot then pops up on the bottom right side of the screen.

Step 4: Type in “Card Activation” in the chatbox and click on the “Send” button.

Step 5: Now click on the “Start: Card Activation”.

Step 6: Provide all the details asked and complete the remaining process to activate your card.

If you are planning to get a TJX credit card for yourself keep your personal and financial details handy and visit a T.J.Maxx store near you and contact the customer service desk. The representative will guide you through the application process. You can also visit “tjmaxx.tjx.com” to apply online. Make sure your credit score is above 620 to increase the chance of approval.

If you have recently got your TJX Reward Credit Card, you must register for an online account to control all the related services of your credit card. Use the below steps to register for a new account.

Step 1: Go to the TJX Reward card login portal.

Step 2: Find and click on the “Register” button.

Step 3: Add your Reward Card number in the first box and the Zip Code in the second box.

Step 4: Click on the “Continue” button below the box.

Step 5: To create the user ID and password complete the remaining on-screen instructions.

Step 1: Go to the TJX Rewards card login portal.

Step 2: Click on the “Find User ID” link placed below the “Secure Login” button. For Password jump to step 5.

Step 3: Enter your Reward Card number and Zip Code in the first and second boxes respectively.

Step 4: Click on the “Find User ID’ link below the Zip Code box. Follow the remaining on-screen instructions to recover your User ID.

Step 5: Click on the “ Reset Password” link below the “Secure Login” button once you are on the TJX card management portal.

Step 6: Add Your User ID and Zip code in the space provided and click on the “Continue” button

Step 7: Complete the remaining process and create a new password when prompted and re-login to your account.

You’ll need a credit score of 620 or above to qualify for a TJMAXX Credit Card.

If your credit score is 670 or above you might be better off with one of the better cash back cards such as the Chase Freedom Flex. The rewards you earn shopping at TJMAXX would have much more flexible and potentially lucrative redemption options with no annual fee.

Synchrony Bank is the financial institution that is the credit card issuer of The T.J. Maxx Credit Card, and it is a Mastercard.

You will have to undergo a hard credit inquiry to apply for a T.J. Maxx credit card. Your Social Security number is used when the credit check is performed so that your credit file can be obtained.

You can pay your T.J. Maxx credit card bill online by logging into your account at MyCreditCard.com. You can also sign up for electronic statements.

To cancel your card, call 800-952-6133 if you have the T.J. Maxx Rewards Card or 877-890-3150 if you have the Platinum MasterCard.

When Payments Are Due. You must pay at least the total minimum payment due on your account by 5 p.m. (ET) on the due date of each billing cycle.

Payments received after 5 p.m. (ET) will be credited as of the next day. You may at any time pay, in whole or in part, the total unpaid balance without any

additional charge for prepayment. If you have a balance subject to interest, earlier payment may reduce the amount of interest you will pay. We may delay

making credit available on your account in the amount of your payment even though we will credit your payment when we receive it.

Payment Options. You can pay by mail or online. We may allow you to make payments over the phone but we will charge you a fee to make expedited

phone payments. Your payment must be made in U.S. dollars by physical or electronic check, money order, or a similar instrument from a bank located

in the United States.

How To Make A Payment. You must follow the instructions for making payments provided on your billing statement. If you do not, credit of your payment

may be delayed up to five days. Your billing statement also explains how information on your check is used.

Payment Allocation. We will apply the required total minimum payment to balances on your account using any method we choose. Any payment you

make in excess of the required total minimum payment will be applied to higher APR balances before lower APR balances. Applicable law may require or

permit us to apply for excess payments in a different manner in certain situations, such as when your account has a certain type of special promotion.

Use Of Your Account. You may use your account only for lawful personal, family, or household purposes. You may use your account for purchases from

T.J.Maxx, Marshalls, HomeGoods, Sierra, and Homesense locations.

You Promise To Pay. You promise to pay us for all amounts owed to us under this Agreement.

Your Responsibility. Each account holder will receive a card. You may not allow anyone else to use your account. If you do, or if you ask us to send a

card to someone else, you will be responsible for paying for all charges resulting from their transactions.

We will charge this fee if we do not receive the total minimum payment due on your account by 5 p.m. (ET) on the

due date. This fee is equal to:

$25, if you have paid your total minimum payment due by the due date in each of the prior six billing cycles.

OR

$35, if you have failed to pay your total minimum payment due by the due date in any one or more of the prior

six billing cycles.

The late payment fee will not be more than the total minimum payment that was due

We figure the interest charge on your account separately for each balance type. We do this by applying the

daily rate to the daily balance for each day in the billing cycle. A separate daily balance is calculated for the

following balance types, as applicable: purchases and balances subject to different interest rates, plans, or special

promotions. See below for how this works.

How to get the daily balance: We take the starting balance each day, add any new charges and fees, and

subtract any payments or credits. This gives us a daily balance. We apply fees to balance types as follows:

(a) late payment fees are treated as new purchases, and

(b) debt cancellation fees are added proportionately to each balance.

How to get the daily interest amount: We multiply each daily balance by the daily rate that applies.

How to get the starting balance for the next day: We add the daily interest amount in step 2 to the daily balance

from step 1.

How to get the interest charge for the billing cycle: We add all the daily interest amounts that were charged during the billing cycle. We charge a minimum of $2.00 of interest in any billing cycle in which you owe interest. This charge is added proportionately to each balance type.

TJMAXX Credit Card Phone Number is 1-800-926-6299.

Customer Service Monday – Friday 9:00 AM – 5:00 PM (Eastern Time) at the following toll-free number: 1-800-926-6299

You have to have a good credit score to be accepted by the TJX Credit Card, which is that you have a credit score of a minimum of 700. If you don’t have a credit score of 700 however, you are still eligible for TJX Store Card TJX Store Card with fair credit that is having a credit score of 640 or greater.

However, it’s important to be aware that having a high credit score will not always guarantee you approval for a specific credit card. Other factors could influence the decision, like your current debts, employment standing, and your annual income.

You can report the loss of a credit card issued by TJX by calling customer support by dialing (866) 419-4096. The card will be canceled and a new one will be sent to you.

If you get your new TJX Credit Card you’ll need to make sure to enable it prior to being able to make purchases. If you have any recurring charges associated with the previous TJX Credit Card, make sure you update your accounts to reflect your new card’s information.

Your TJX Credit Card is covered by a zero-fault fraud liability which means you won’t be held accountable for purchases that were not authorized using your card when it’s missing. However, you should notify the card’s owner immediately and contact the provider if you discover the account has been billed with charges you aren’t familiar with.

You can verify the balance of your TJMaxx Credit Card balance by dialing 1-877-890-3150 or using the number printed on the reverse of the card. You can also view your balance online, by login into your bank account. From there, you can check your reward balance, pay bills, or sign up for electronic statements.

Thanks For Visiting this website any doubts, you can comment below; if you want to latest updates on this type of helpful information, follow Google News.