The Home Depot Credit Card is offered by Citibank that can be used to purchase at stores. The cardholders have the option to enroll in paperless statements and e-communications.

This means that cardholders will receive legal notices, such as notices of increases or decreases in credit lines, privacy notices, account updates, and statements, electronically instead of through the mail. Home Depot” offers a credit card but doesn’t provide more detailed information as the website mainly focuses on the customer experience and benefits of using the credit card.

Below is the key information you need as a credit card holder to access and manage your account online, make payments, and reach customer service for further customer service. Citibank issues the Credit Card, and Citibank provides all of the services on behalf of Home Depot.

Home Depot Credit Card Info

Being a retail card, the Consumer Credit Card can only be used at this establishment. On purchases of $299 or more, the card enables access to exclusive promotional periods in addition to 6 months of special financing. No interest is paid if the item is paid off throughout the special financing term, but deferred interest is levied from the purchase date if the transaction is not paid off in full.

In addition, cardholders have an additional advantage of a full year to return items, which is four times the amount allowed by Home Depot’s standard return policy. The card also provides zero legal coverage for any illegal payments to the account.

Pros & Cons

| Pros | Cons |

| ✅Qualify with fair credit | ❌Deferred interest |

| ✅No membership fees | ❌No rewards |

| ❌High Regular APR |

How to Login into Your Online Home Depot Card Account on the website?

- To begin with, you already have an Online login account. The application process is easy to follow if you don’t already have an online HD account. Please read the directions on this page, as we kindly request you do. You will not be able to sign in till then.

- It is necessary to have a steady internet connection.

- Before you begin the login process, ensure you have dependable internet security software installed on your computer, like Avast Internet Security.

- Browser Use Chrome or Safari

- Must you have a Home Depot Credit Card?

The two most popular methods for signing in are through websites and applications. Both of these ways require an internet-connected device, such as a laptop, PC, phone, or similar device.

- First of all, visit the official login website by tapping the URL: https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLCN_HOMEDEPOT

- After that, click on Sign On.

- Enter your Login details, User ID, and Password.

- After Filling in all the details, click on Sign On.

- You are logging in successfully.

- After logging into your account, you can access and manage your card anytime; that’s the beauty of online features.

Instruction Video for Logging into Home Depot Credit Card on the website:

How to Access With Mobile App?

To access your credit card from the Mobile App, read and follow each step below. But Before credit card login from Mobile needs the Home Depot Mobile App. If you already have a Mobile App, skip these steps and follow the Login with App. Should you download a Home Depot Bank Credit Card Mobile App?

Yes. It’s advantageous to have a mobile app to log in to the credit card account; downloading the app is free. In truth, it does more than merely function as a credit card app. Following are some benefits of the credit card mobile app login:

- You can monitor the balance of your Home Deposit Service bill payments.

- It will be simple to check and keep an eye on your balance.

- The ease of checking your account’s transaction history is provided through the Home Deposit Service.

- It sends you updates regularly about fresh incoming and selling offers.

- Home Deposit’s online service allows you to view your orders and payments.

- The credit card can be used to fund in-store purchases.

- Online bill payment is quick and straightforward.

- The Home Deposit Service does not offer a 60-day interest period for commercial cards.

- You may lower your interest by using the Credit Card.

If you want to install the credit card mobile app and log in to your online account, follow the instructions below.

Step 1: First of all, Download the Home Depot Mobile App.

Click the link below to download the mobile app for your Android device or Apple.

- Download the Mobile App on the Google Play Store

The mobile app can be found on Google Play or downloaded from this link: Home Depot Mobile App on Google Play.

- Download the Mobile App on the IOS Store

You may find the App in the App Store or by following this link: Home Depot Mobile App on App Store.

Step 2: After that, Install the Mobile App.

- After downloading the Mobile application, install this app on your Mobile, and the logging-in screen will display on your mobile.

- Open your App and Enter your login details, User ID, and Password.

- After filling in all the details, click on Sign In.

- You are logging successfully into your credit card account.

Note: If you are unable to access the Home Depot Mobile App?

You may be experiencing trouble logging into your account on the app for various reasons. The most common reason is incorrect login details. You may avoid this by verifying your information before logging in.

You cannot log in during these hours, but you will be notified beforehand; Regular software upgrades will be performed. If the login page does not appear, ensure your browser’s login account type is configured correctly or update your IP address.

How Do You Retrieve a Forgotten Home Depot Card Username or Password?

- First of all, visit the official website by tab on the URL: https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLCN_HOMEDEPOT

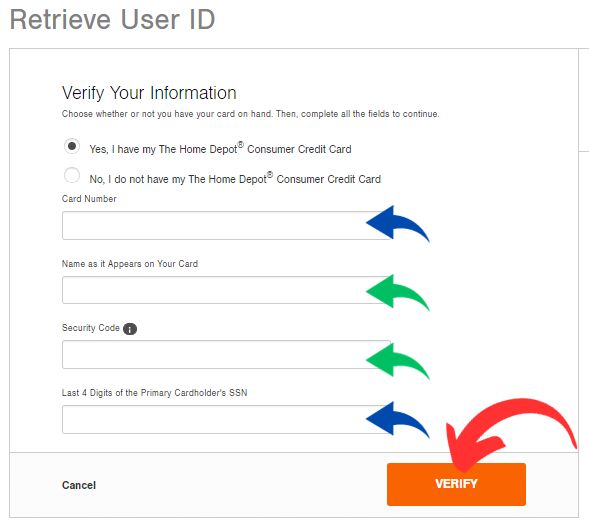

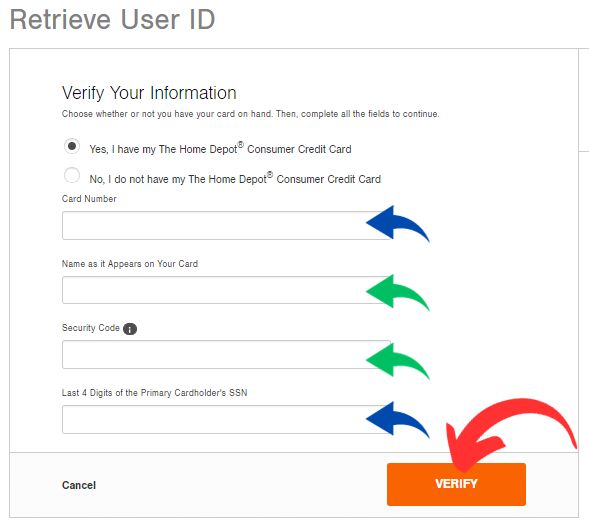

- After that, click on Retrieve User ID.

- Enter some required details for getting forgotten User ID, Card Number, Name as it Appears on Your Card, Security Code, and Last 4 Digits of the Primary Cardholder’s SSN.

- After Filling in all the details, click on Verify.

- After verifying your credit card details, enter the needed details and adhere to the instructions.

After following the above steps, I hope you can easily recover your login user ID. If you are facing any issues, call customer service at 📞1-800-677-0232.

If you have a Login User ID but need to remember the Password, you can reset your login password at home or anywhere. Following this process, you can easily reset your account password.

Reset your Home Depot Credit Card Login Password

- First of all, visit the official website by tapping the URL: https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLCN_HOMEDEPOT

- After that, click on Reset Password.

- Enter some required details for getting a forgotten Password, Card Number, Name as it Appears on Your Card, Security Code, and Last 4 Digits of the Primary Cardholder’s SSN.

- After Filling in all the details, click on Verify.

- After verifying your credit card details to change your password, enter the needed details and adhere to the instructions.

How to Register Your Online Home Depot Credit Card Account?

Follow the process given below to open a credit card account. However, before registering, keep your personal or financial information accessible.

- First of all, visit the official website by tapping on the URL: https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLCN_HOMEDEPOT

- After that, click on Register your card.

- Enter some required details enter your card number, Name as it Appears on Your Card, Security Code, and Last 4 Digits of the Primary Cardholder’s SSN.

- After Filling in all the details, click on Verify.

- After verifying your details, enter the needed details and adhere to the instructions.

How Do I Apply For a Home Depot Credit Card?

You may apply for The Consumer Credit Card* and other branded, co-branded, or store products online, but you can also apply in person with any store card. Since eligibility is based on creditworthiness, a credit check will be run before approval is granted, and approval is not guaranteed.

Based on your creditworthiness, the card issuer will determine your purchase APR or other applicable terms specific to the product you are applying for. You can pre-qualify on the website to gauge the likelihood of your approval and what terms you may be given.

To apply for a Home Depot® Credit Card, you can fill out an application on the website or any Home Depot store. You must provide some personal information, such as contact info and your Social Security number. Once you submit your application, you’ll generally get an instant decision, but some applications can take up to 10 business days to be reviewed. At the moment, applying by phone is not an option.

Must Need to Know Before Apply for a Credit Card

- Credit Score: You must have a Minimum 640+ Credit Score

- Age requirement: Must be at least 18 years old. If under 21 years old, must have proof of independent income or a co-signer.

- Residency requirement: Must be a U.S. resident. Address must be in one of the 50 U.S. states or Washington D.C. No P.O. box addresses will be accepted.

- Social Security Number

- ID Proof: You have just an ID proof like a Driving License.

How to apply for a Home Depot® Credit Card:

- Go to the “Credit Center” section of the website.

- Scroll down to the credit card you want to apply for. Aside from the Consumer Credit Card, a few other options exist.

- Click the “Apply Now” link above the credit card you wish to apply for. This will send you to the credit card application on the issuer’s website.

- Fill out the application.

- Review and agree to the credit card terms at the bottom.

- Click “Submit Application.”

- Wait for the decision page to load to see if your application has been approved.

Applying for a Credit Card in-store is a similar process. Go to the customer service desk or ask a cashier for an application. Once you fill it out, they’ll process it, and you should get an instant decision. If they need to review your application further, you will be notified of a decision within 7-10 business days.

After receiving your card, you need to activate, it because, without activation, your card did not work, so follow the instructions below and activate your card easily setting at home.

How Can I Activate my Home Depot credit card?

Two ways to activate your Card:

- Call Credit Card Customer Service at 📞1-866-875-5488 and follow the instructions.

- The second is online, by registering here. You must then log in to your account to activate your new card.

How can you use the Home Depot card to make payments?

As proven by its tremendous growth in 2022, Home Depot is a leading choice among buyers to acquire home renovation goods and services. The Citibank HomeDepot credit card lets you keep the associated costs apart from your other expenditures, regardless of whether you have a modest restoration project or a significant build to take on.

It also offers perks like one-year hassle-free returns, special daily finance on purchases of $299 or even more, and special cardholder credit offers. Additionally, some credit card options from Home Depot have special financing for up to 24 months. After making purchases with your card, take these procedures to make payments.

Here is how to make a Home Depot Credit Card Payment Bill:

- Online: Log in to your account to pay and manage your account.

- By Phone: Call customer service at 📞1-800-677-0232 and follow the prompts to make a payment.

- With Mobile App: Apple and Google App

- Via Mail: Send your cheque or money order to the following address:

- Note: Before sending any details, please call Customer Service and Confirm the Mailing Address.

| 📍Payment Address | |

| Consumer Card Payments | P.O. Box 9001010, Louisville, KY 40290-1010 |

| 📍The Home Depot® Consumer Credit Card Payment P.O. Box 9001010 Louisville, KY 40290-1010 | |

| 📍PO Box 70600 Philadelphia, PA 19176-0600 | |

| Overnight Payment | Consumer Payment Dept. 📍6716 Grade Ln STE 910 Louisville, KY 40213 |

Home Depot Credit Card Phone Number

- Customer Account: 📞1-800-677-0232

- Phone Number: 📞1-800-466-3337

- Primary Customer Service: 📞1-800-HOME-DEPOT (466-3337)

- Commercial Revolving: 📞1-800-685-6691

- Homedepot.com Major Appliances Help: 📞1-877-946-9843

- Commercial Accounts: 📞1-800-395-7363

Benefits of Home Depot Credit Card

Lots of Benefits in Credit Card The length of your financing period depends on the size of your purchase. You get 24 months of financing for purchases of $5,000 or more, 12 months for purchases of $1,000-$5,000, and 6 months for $299-$999.

You also get up to a year to return a product. Plus, Home Depot regularly runs promotions to encourage you to finance purchases with the card.

- 6 Months of Financing* on purchases of $299 or more.

- • Up to 24 Months of Financing* during special promotions.

- • 1 Year to Make Returns – 4X longer to make returns, just for being a card member. Refer to The HomeDepot Returns Policy for details.

- • Zero liability on unauthorized charges.

- • Credit card limits based on creditworthiness.

- • Minimum payments required

- Check to see if you pre-qualify without impacting your credit score.

Read our previously published article on Home Depot Credit Card Lost.

How to get in touch with Home Depot Customer Service if your Card Account isn’t working?

- Credit Card Customer Service 1-800-455-3869

- Homedepot.com Online Order Support 1-800-430-3376

- Primary Customer Service 1-800-HOME-DEPOT (466-3337)

- Consumer Credit Card Account 1-800-677-0232

Monday-Saturday: 6:00 am – 1:00 am ET Sunday: 7:00 am – 12:00 am ET

- Commercial Revolving Charge Card 1-800-685-6691

- Commercial Credit Card Account 1-800-395-7363

Referral Links

✅Login: Visit Here

✅Apply online: https://www.homedepot.com/account/view/thdcreditcard

✅Gift Cards & Store Credits: https://www.homedepot.com/c/Gift_Cards

✅Customer service: https://www.homedepot.com/c/customer_service

✅Check Order Status: https://www.homedepot.com/order/view/tracking

✅Order Cancellation: https://www.homedepot.com/c/Customer_Support_Answers#cancel

✅Store Finder: https://www.homedepot.com/l/search/121/full/

Frequently Asked Questions

Login to your account and tap on balance; after that, display your balance on your screen.

You can’t sell your Store credit because it is tied to your ID number. You are the only person who can use it. It will be refused as tender if it does not match.

640 credit score is required for approval for a credit card.

Yes, New cardholders receive a small discount. The HomeDepot Consumer Credit Card offers $25 off purchases of $25 to $299, $50 off purchases of $300 to $999, and $100 off purchases of $1,000 or more on new accounts.

The Project Loan provides cardholders with a massive line of credit (up to $55,000), six months to make purchases, and up to 9.5 years to pay it off.

Grace Period of Credit card 25 days after the closing date of your billing cycle.

Home Depot credit card has a late fee of up to $40, which applies when cardholders don’t make the minimum payment by the due date.

The Home Depot® Credit Card annual fee is $0 per year.

You can check your application status by calling customer service at (800) 677-0232. When you call, you’ll need to provide your Social Security Number. You cannot check your status application online.

Check our previously published article on Ann Taylor Credit Card Login & Payment.

Conclusions.

This page contains all the information a Home Depot credit card account user would require. Using these credit card details, you can make payments, contact customer service, and log into your account online.

Thanks For Visiting this website any doubts, you can comment below; if you want to latest updates on this type of helpful information, follow Google News.